Dedicated solutions for companies, institutions and large groups.

Investing in crypto-assets carries risks of liquidity, volatility, and partial or total capital loss. Crypto-assets held are not covered by deposit and securities guarantee mechanisms.

Sign up for our newsletter

Partners

Coinhouse

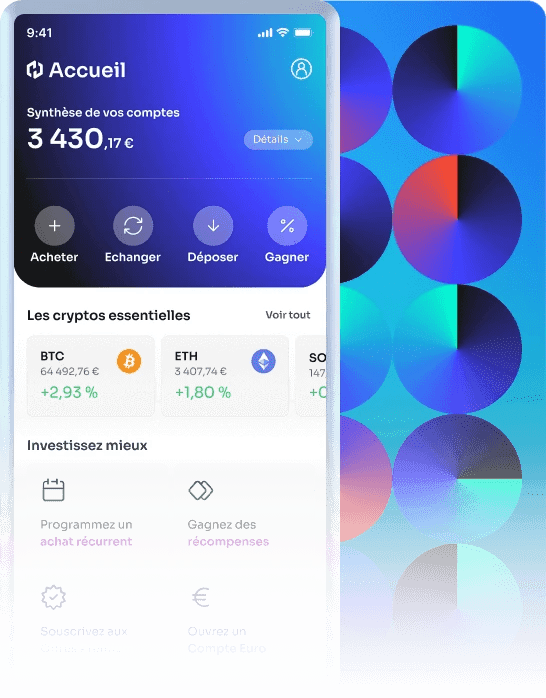

Our accounts

Coinhouse

Coinhouse SAS with a capital of €210,000, RCS Paris 815 254 545, headquarters: 14 Avenue de l'Opéra 75001 Paris – support@coinhouse.com. Registered with the AMF for activities related to the purchase/sale of digital assets against legal tender, the exchange of digital assets for other digital assets, and the custody of digital assets for third parties under the registration number: E2020-001.

Coinhouse payment solutions

Company registered with the Paris RCS under the number 914 384 557, registered with the Prudential Control and Resolution Authority as a payment service agent under the number 727503 of the electronic money institution Treezor, headquartered at 33 Avenue de Wagram, 75017 Paris.

General conditions, disclaimers and legal documents.

Dedicated solutions for companies, institutions and large groups.

The security of your assets is a major issue in crypto. Right from the start, Coinhouse created Coinhouse Custody Services, a branch dedicated to asset custody.

Segregated accounts.

Storage of your cryptos in partitioned accounts.

Cold storage.

Off-grid storage for best-in-class security. Your cryptos remain accessible from a few hours to a few days.

Multi-signature.

A solution adopted by major accounts to address governance and security issues.

Pre-authorization of a list of public addresses.

To restrict the number of beneficiaries, and make your payments easier.

Transaction restrictions.

In value, and in frequency.

Know more

Discover our levels of support, from guided autonomy to dedicated advisor.

You have the right to ask questions

Can’t find your answer? Visit our help center.

PSAN stands for Prestataires de Services en Actifs Numériques.

This is a status created in France in 2019 following the PACTE law, in order to provide a framework for activities linked to crypto-assets and other digital assets.

PSANs are subject to specific regulations from the AMF (Autorité des Marchés Financiers), which notably impose obligations in terms of security, transparency and investor protection.

PSANs are authorized to provide buying/selling, custody and management services for crypto-assets and other digital assets such as tokens.

They may also offer investment advisory services in digital assets and trading services on behalf of third parties.

Optimizing cash flow is important for all companies.

First and foremost, many companies choose to optimize their cash flow in order to limit risks in the event of insufficient cash, but also to enable a company with surplus cash to invest it.

There are a number of strategies for making cash grow, including investing in equities, bonds and real estate.

Investing in crypto-assets, however, is a strategic investment when it comes to cash optimization: indeed, crypto-assets are one of the few asset classes capable of outperforming inflation.

In this way, dormant cash will be able to grow and enable these companies to cope with the loss in value of their capital.

A company wishing to grow its cash quickly finds itself faced with this question: should it seek support to invest in crypto with its cash?

While some executives prefer to invest their cash in crypto on their own, others may prefer to be accompanied by teams of experts.

In particular, a crypto support expert will be able to best inform the executive or CFO of the risks involved in investing in crypto-assets and how best to prevent them, but also be able to answer companies’ questions about governance within the company, or how to approach the market from the point of view of investment security and regulation.

Finally, an expert in crypto support will be able to guide companies towards an informed investment in the right crypto-assets and the best yield products, and inform the company throughout the relationship of the best trade-offs to be made according to the market.