International Payments and Transfers

A single 1.49% rate for all your payments. Faster, more cos-effective, and more secure.

A single and transparent rate, for all amounts and all countries.

A Bitcoin transfer takes on average 30 minutes. An international transfer,

3 to 5 business days.

The average annual performance of Bitcoin between 2013 and 2023.

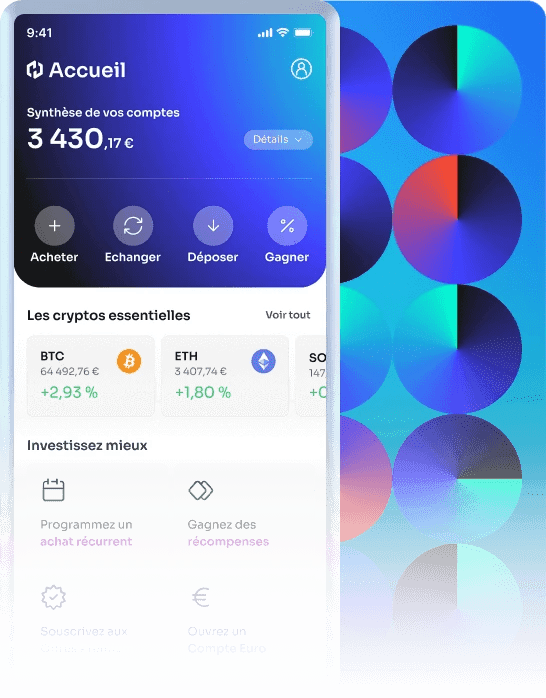

A crypto account for all your payments

Receive payments from around the world

Reduce intermediaries

A single, transparent rate.

A tailor-made offer for all your recurring transfers

Manage all your transfers with our dedicated offer:

- Accounting assistance

- Reduced transfer fees.

Automatic conversion to stablecoins to mitigate volatility risks

Payment automation

Dedicated business account manager

You can do it with crypto

Crypto with security

1.One of the most reliable security solutions on the market

2.Cold storage service

3.Segregated accounts upon request

Find out more

Free but not alone

Discover our levels of support, from guided autonomy to dedicated advisors.

Receive investment opportunities in real time

Get advice from a specialist

Frequently Asked Questions

You have the right to ask questions

Can't find your answer? Visit our help center.