Banks and Institutions

Bitcoin worries the Bank of France

Bitcoin worries the Bank of France: its governor François Villeroy de Galhau said that a regulatory framework should be imposed "as quickly as possible" on digital assets as well as their transactions. "We don’t have much time left, 1 or 2 years". These measures could be aimed at protecting the euro, pending the release of a hypothetical European central bank digital currency (CBDN).

Source : Journal du Coin

Wyoming, first state to recognize a DAO

Wyoming, arguably the most digital asset friendly state in North America, has announced that it now legally recognizes the first Decentralized Autonomous Organization (DAO), in the United States. The DAO American Cryptofed, which runs a crypto project based on aj stablecoin, Ducat, is therefore now a legal entity in the United States. As a reminder, a DAO is a decentralized organization whose operation is entirely managed by smart contracts.

Source : Coin Telegraph

Investment funds can invest up to 20% of their portfolio in digital assets in Germany

In Germany, the fund location law, introduced in April and approved by parliament, allows investment funds to invest up to 20 percent of their portfolios in crypto. The law went into effect today. In theory, if all German funds truly invested 20% of their total portfolio in crypto, that would equate to $415 billion in digital asset investments.

Source : Techyno

Chinese crackdown on cryptoassets continues

The crackdown on China’s crypto ecosystem continues: the People’s Bank of China (PBoC) and the Beijing Financial Supervision and Administration Bureau have announced that they have taken Beijing Qudao Cultural Development Limited out of business, accused of providing software services to companies trading in crypto-currency.

Source : The Block Crypto

Binance again in the sights of national regulators

Binance is increasingly targeted by authorities in a growing number of countries. Customers of Barclays Bank based in the UK will no longer be able to make payments to Binance. In Thailand, the national regulator has filed a criminal complaint against Binance because of their unregulated operations. In the Cayman Islands, the regulator has also announced that an investigation will be opened against Binance, again due to their operations without a license to do so.

Source : The Block Crypto

Cryptoactive ecosystem

Bitcoin and Ethereum miners’ income declines

As a result of the hashrate drop due to China’s mining bans, Bitcoin’s mining difficulty dropped by almost 28%, the largest drop on the network since it went live in 2009. The average time to produce a block on the network had lengthened considerably: during the month of June, Bitcoin miners’ revenues dropped by 42% compared to May. For Ethereum, a 53% drop in revenue was recorded. On the other hand, classified ads for private hydroelectric dams are flourishing in the country, no doubt in part due to the disappearance of chinese miners.

Source : The Block Crypto & Coin Telegraph

Aave introduces decentralized finance to institutional clients with the launch of Aave Pro

Aave is approaching its highest price level in 3 weeks, crossing $344. This sudden rise can be explained by the upcoming creation of an institutional lending platform, Aave Pro. This platform will give institutional players easy access to decentralized finance, offering Bitcoin, Ethereum, USDC liquidity pools, among others, as well as Aave, its own token.

Source : Coin Telegraph

Enzyme assets show strong growth

The price of the Enzyme asset (MLN) is up sharply: +92% in one week. Several pieces of news can explain the interest of investors. First, several exchanges, including Binance, have listed it recently. Secondly, partnerships are being formed with DeFi players, Yearn being one of them. And finally, Enzyme’s funds under management have doubled in less than a month.

Source : Coin Telegraph

Technology

An error in the original web code sold by Sotheby’s as NFT

While an NFT representing the original source code of the web was sold by Sotheby’s for $5.5 million, an error occurred when the text file was converted to HTML: the signs "<" and ">" were mistakenly replaced by "<" and ">," making the code invalid and impossible to correct. Some art world experts have stated that this makes the NFT all the more valuable.

Source : Twitter

Ethereum Classic, a revolution in the making?

Ethereum Classic may rise from the ashes, after its original developers announced the complete abandonment of the project. A major update named Magneto will be released in July, which includes four developments deployed on the Berlin update of Ethereum.

Source : Journal Du Coin

Polygon to offer data storage services

The Polygon project is getting into data storage. After revolutionizing Ethereum blockchain transactions with its L2 project, the project is launching a new blockchain, Avail, designed to store data from L2 protocols and other sidechains. Any Ethereum-based protocol will be able to use this dynamic storage to secure its transactions.

Source : Coin Telegraph

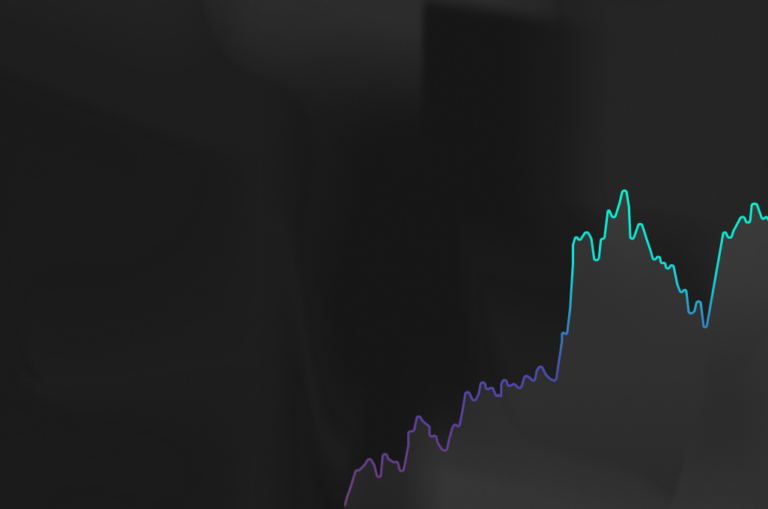

Figures of the week

56%

The volume of transactions recorded on trading platforms fell by 56% during the month of June compared to May, recording 953 billion dollars, against 2180 thousand billion.